I anchored our fast-paced design and development work in insights from users. My main responsibilities include devising research strategy, writing protocol, conducting user studies, analyzing data, and presenting findings to clients.

The first major task our clients asked for help with was finding the right market vertical for their product to launch in. To accomplish this, I came up with a plan for leveraging contextual and remote interviews as a primary method for the exploratory research phase (February - May 2018) of our capstone project.

You can learn more about our research strategy in the presentation below. I also developed protocol surrounding our research interviews, assisted with recruitment methods, and lead data analysis for our three month exploratory research phase.

Hold on a minute. You might be wondering: Why qualitative methods for such a large-scale exploration of potential markets? Why not a survey instead?

A qualitative approach suit our purposes for several reasons. First, our team needed to personally understand the concerns and needs of users from a variety of different verticals in order to narrow down on the ones with the most potential. Second, large-scale methods like surveys would be incredibly hard to do correctly in the short time span we had to identify a vertical and start designing. Third, a lack of scalability in our methodology wasn't a worry since we were comfortable with a high amount of false negatives in order to find one true positive for our market.

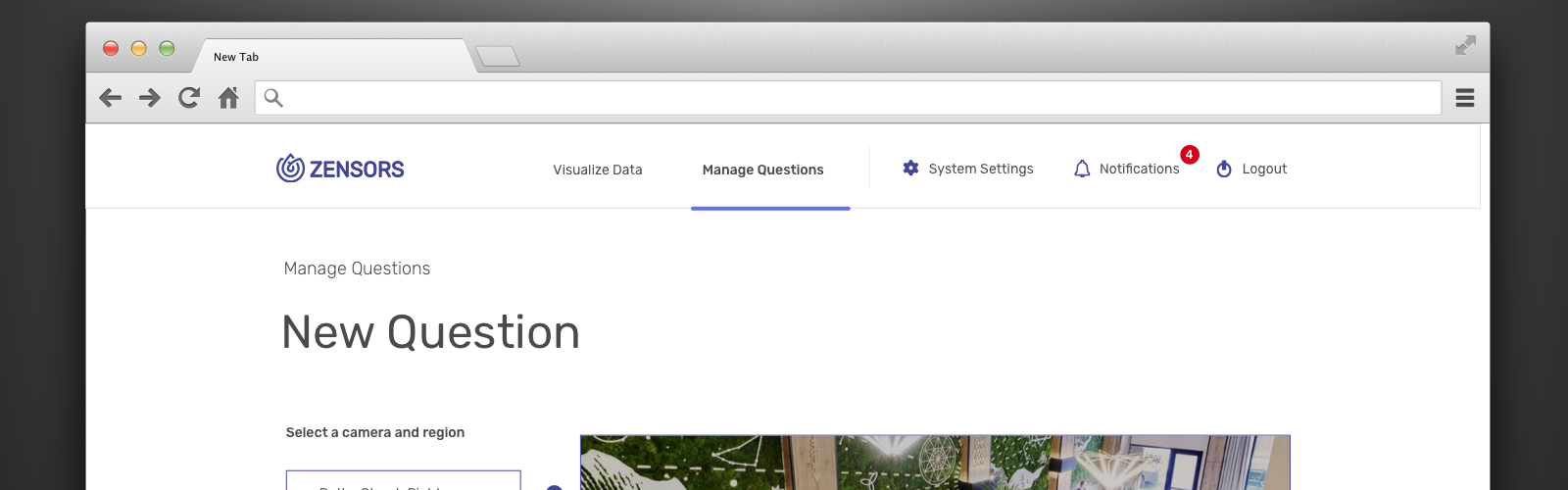

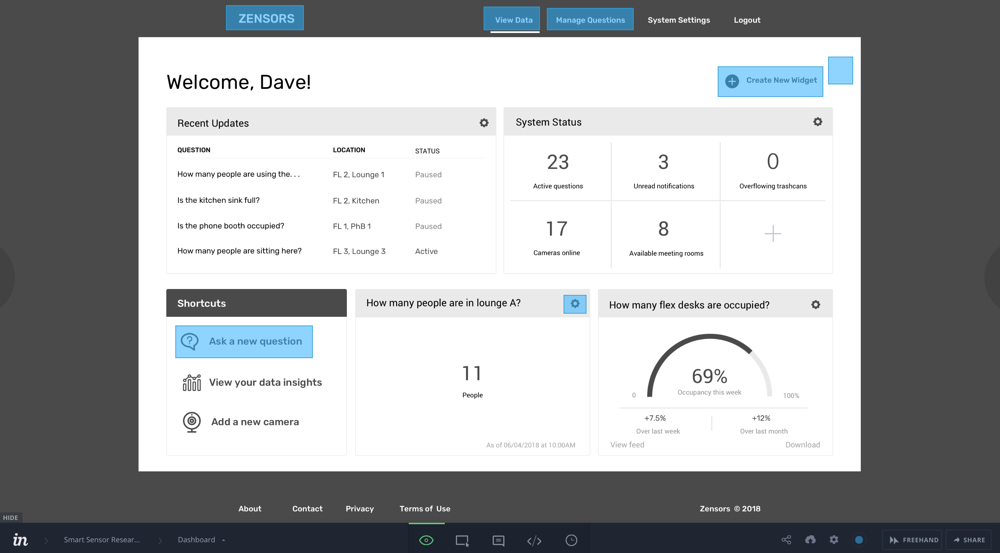

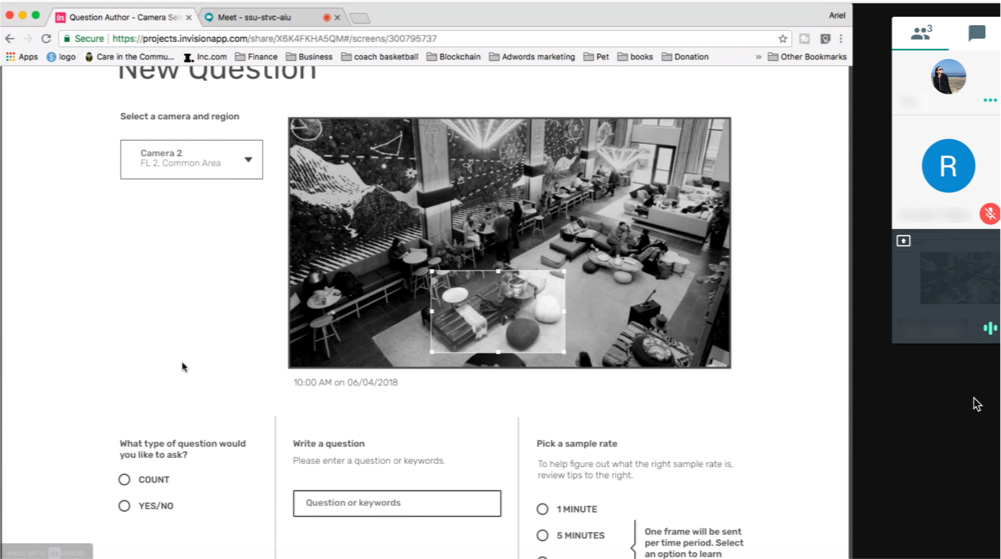

Based on this strategy, we interviewed 30+ professionals across 11 different market verticals over one month. These verticals were decided through discussion with our client and personal research on industries that benefited analyzing physical spaces. Reddit, craigslist, Facebook, LinkedIn, personal connections — we cast a wide net to recruit participants. We synthesized our user interviews using thematic analysis and heat mapping to provide a convincing argument to our clients that Zensors could make a strong impact in coworking and baking industries.

We presented our initial findings to our clients in a formal presentation and made a strong case for pursuing coworking and baking that had the possibility of being a strong fit for Zensors.

Our next step was to discover more about coworking spaces and baking. While most of our interviews were conducted remotely, we also had the opportunity to do contextual interviews including visits to coworking offices and bakeries. We quickly realized that industrial baking wasn't as promising as it originally sounded, and shifted the remainder of our exploratory research phase to verifying that coworking would be a strong vertical for Zensors.

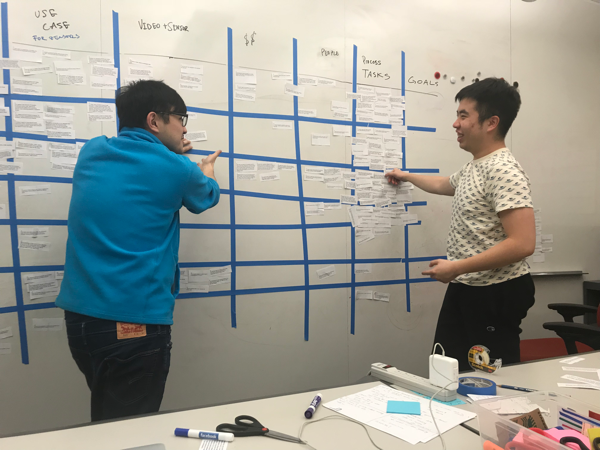

Here are some photos of our visits to coworking offices to speak with employees about their needs. Contextual interviews also contained a post-it exercise in which we asked the participant to walk around their facilities and tag objects or locations they would want to obtain data about.

After three weeks of in-depth research on coworking, we ended up with a mountain of interview data collected from over 10 different companies. Based on this data, I wrote three personas that embodied the broad categories of potential users that we saw.

These personas helped inform our design process and became a core part of a presentation to the Future Interfaces Group in which we presented the results of our market research, user research, and design strategy from February 2018 to May 2018.